Keep track of all of your transactions, even from your smartphone with online accounting & invoicing software like Debitoor. Because transactions in a suspense account are unallocated, the account should be considered temporary. A partial payment occurs when a customer does not pay the full amount owed for a transaction. Partial payments can come in many different forms, such as a deposit on a real estate transaction or an upfront payment for a service order. For example, payments may be received with invalid or unclear account information. Other details may also be unclear, such as the amount of the transaction or the payee.

Importance of Suspense Accounts in Accounting

Businesses may decide to clear their suspense accounts quarterly, while smaller companies may https://www.bookstime.com/ do so more often. As the name suggests, a suspense account is an account that temporarily records amounts that are yet to have their proper accounts determined. In balance sheet terms, a suspense account is not ideal, as it can prevent you from accurately balancing the books. However, in your day-to-day business activities, using a suspense account in accounting is much like placing a document on a “to file” pile.

Example #1: Unknown Invoice

But many companies try to complete this process on a monthly or even quarterly basis. As its name implies, this account is reserved for an unidentified transaction. It remains suspence account temporarily suspended until further research reveals its destination or classification.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- Consequently at the end of each accounting period the business carries out a suspense account reconciliation.

- The unreconciled differences are placed in suspense accounts until the underlying causes are investigated and resolved, at which point the balances can be adjusted to reconcile the accounts accurately.

- It is like a temporary shelf where all the “miscellaneous” items can be parked until their actual nature can be ascertained.

- While the accounting team reviewed transactions to identify errors or unaccounted items, they temporarily opened a suspense account to balance the books and ensure the accuracy of their financial reporting.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Is suspence account?

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- Suspence account is used where there is one or more debit orcredit account information is missing in transaction due tounavailability of information or any other reason to balance outthe transaction for time being.

- And the default suspense account acts as an all-purpose vessel to ensure the safety of the funds.

- The suspense account is situated on the general ledger and is used to temporarily store specific transaction amounts.

- Depending on how long you’ve been in business, you may or may not have come across suspense account transactions.

When the trial balance does not tally due to unknown discrepancies, a suspense account is used to balance the books temporarily. For instance, at ABS, a discrepancy of $500 was discovered between credits and debits. While the accounting team reviewed transactions to identify errors or unaccounted items, they temporarily opened a suspense account to balance the books and ensure the accuracy of their financial reporting. A suspense account is essentially a bookkeeping technique for keeping track of funds for a brief period until particular issues are resolved. A business can use a suspense account to record payments it has received but that can’t be properly accounted for until certain missing information (such as an invoice number) is obtained. In mortgage servicing, it is a way for the servicer to record incomplete monthly payments until the borrower has made the payment in full.

- Imagine JKL Enterprises received a partial payment of $300 on a $1,000 invoice.

- If you get a payment, but you don’t know who has sent it, you may need to place the amount in a suspense account.

- Suspense accounts serve as a placeholder until the missing or uncertain details are resolved, when they would be moved back into the general ledger.

- When you access this website or use any of our mobile applications we may automatically collect information such as standard details and identifiers for statistics or marketing purposes.

- He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

Identifying Suspense Accounts

- The most important point to understand is that transactions are recorded in the suspense account only temporarily and need to be relocated to their correct permanent accounts as soon as possible.

- Accordingly irrespective of the issue resulting in the suspense account posting, at the end of the accounting period the account balance reduces to zero with correcting journal entries.

- It is, therefore, imperative for organizations to proactively manage and resolve suspense accounts to mitigate these risks effectively.

- Here, the mortgage servicer can use suspense account transactions to deposit the first half of the payment.

- There are several errors that may be revealed by the trial balance which involve the suspense account.

- Having been correctly identified, the interest expense account now contains the correct amount of 1,000.

Having been correctly identified, the interest expense account now contains the correct amount of 1,000. The suspense account maintains the double entry at the time of posting when the correct account is unknown. Subsequently when the business determines the transaction classification it transfers the amount from the suspense account to the correct account.

Characteristics of a suspense account:

Until you actually make the withdrawal from the agent or financial institution, the remittance money may be stored in their suspense account. There is an uncertainty regarding transaction classification at the time of its entry into an accounting system. Then, the mortgage service provider can choose to allocate part of the funds received elsewhere. This includes the principal owed, property taxes, accrued interest, and homeowners’ insurance plans.

Get in Touch With a Financial Advisor

A suspense account helps to isolate the impact of system errors until the necessary system corrections or manual adjustments can be made. In situations where a financial transaction spans multiple accounting periods, a suspense account can be used to hold the entry until the appropriate period is reached. This is particularly https://www.facebook.com/BooksTimeInc/ relevant when accruals or deferrals are involved, where the transaction occurs in one period but is not recognized until a subsequent period. One important use of a suspense account is to bring the trial balance into agreement.

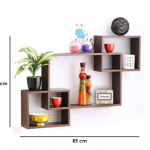

ارفف

ارفف الجزامات

الجزامات وحدات التلفزيون

وحدات التلفزيون وحدات الحمام

وحدات الحمام غرف الاطفال

غرف الاطفال السراير

السراير ترابيزة قهوة

ترابيزة قهوة ترابيزة جانبية

ترابيزة جانبية

الركنات

الركنات كراسي

كراسي كنب سرير

كنب سرير ليزي بوي

ليزي بوي

المطابخ الجاهزة

المطابخ الجاهزة وحدات المطبخ

وحدات المطبخ دولاب

دولاب كومود

كومود