After providing a few basic details about your business — name, type, currency you use, address — you’ll have instant access to your account. We believe everyone should be able to make financial decisions with confidence. The rate that you charge for your freelancing services can vary, so it’s important to get a grasp of market trends before sending your clients an invoice or quoting a price. Freelance rates can differ depending on experience level and industry. For example, the rate a freelance web developer charges may be different than that of a freelance graphic designer, because each freelancer specializes in introduction to cash budget a different area.

For more information, see the developer’s privacy policy. Ready to invoice in style, bookkeep less, and get paid fast? “It’s not just a cool piece of software, it is giving peace of mind to people.” You deserve to know your taxes aren’t something you have to sweat over the entire calendar year.”

Money is deposited

QuickBooks Online’s detailed reporting and transaction tracking is ideal for growing businesses. Only integrates with in-house apps, like Wave Payments and Wave Payroll; does not integrate with card readers for in-person payments. “Wave invoicing makes your life a whole lot easier and takes that worry off you. I’ve tried Quickbooks—it’s a bit more complicated and technical, and takes more time to set up.” Monitor your cash flow, stay organized, and stop sweating tax season.

Button-up your bookkeeping

There are also add-on Intuit services like QuickBooks Payroll or QuickBooks Time. Includes tools that help automate the reconciliation process and auto-categorizes transactions for you in the Pro plan, but you can’t set up your own bank rules; no global search function. Our (non-judgmental) team of bookkeeping, accounting, and payroll experts is standing by to coach you—or do the work for you. We built our payroll tool for small business owners, so it’s easy to use AND teaches you as you go. Know when an invoice is viewed, becomes due, or gets paid, so you can stay on top of your cash flow better than ever. Xero lets you add unlimited users in all plan tiers and, similar to QuickBooks Online, can grow alongside your business.

Get paid online

Simply email your customers an invoice and they can use the secure “Pay Now” button to send over your payment. FreshBooks is an affordable option for freelancers and small service-based businesses that operate mostly on the go. Compared with free software like Wave, QuickBooks plans are expensive. The most basic plan, Simple Start, costs $30 per month, and the top-tier Advanced plan costs $200 per month, which is a sizable investment if you’re running a business on a tight budget.

I look at the dashboard and know how many invoices are on the way, when they should be paid, and the average time it takes someone to pay. You’ll receive the money in your account in 1 business day (Canada), or 2 business days (US)1. Zoho Books offers a robust free plan, along with a range of paid plans that feature workflow automation. Moreover, you can integrate QuickBooks with hundreds of third-party tools available in the app marketplace.

Deposit times may vary due to processing cutoff times or third party delays. Your customers can pay the invoices you send them instantly by credit card, secure bank payment (ACH/EFT), or Apple Pay. And by enabling Wave’s payments feature, you can accept credit cards and bank payments, and get paid out in as fast as 1-2 business days1. Wave’s invoicing is free and unlimited, with customizable templates and a user-friendly interface, putting it on par with some of the best invoicing software solutions for small businesses.

NerdWallet’s accounting software ratings favor products that are easy to use, reasonably priced, have a robust feature set and can grow with your business. The best accounting software received top marks when evaluated across 10 categories and more than 30 subcategories. Learn how much does email marketing cost in 2021 more about how we rate small-business accounting software. Know when an invoice is viewed, becomes due, or gets paid, so you can take the right actions to manage your cash flow. Set up invoice reminders to automatically email your customers when payment is due. All your invoicing and payment information automatically syncs with our free accounting software included with your account.

Customers can click a Pay Now button on invoices and pay instantly by credit card, secure bank payment (ACH/EFT), or Apple Pay. You can accept credit cards and bank payments for as little as 1%2 per transaction. Wave Accounting’s Starter plan is free and its Pro plan, which includes more features, is $16 per month.

- Although accounting and invoicing are separated into two different product sections on the Wave website (shown similarly below), they don’t require separate accounts.

- Our partners cannot pay us to guarantee favorable reviews of their products or services.

- It’s also missing an audit trail and third-party integrations.

- Easily monitor and keep track of what’s going on in your business with the intuitive dashboard.

Sign up for Wave and send your first invoice right away—it only takes a few minutes! With the Pro Plan you can also price earnings pe ratio formula calculator 2023 set up recurring payments, auto-reminders, and deposit requests to make sure you always get paid on time. Every invoice paid means more revenue coming into your small business. Create and send professional invoices to your customers in seconds. When everything is neatly where it belongs, tax time is simple. Wave’s smart dashboard organizes your income, expenses, payments, and invoices.

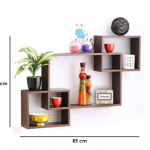

ارفف

ارفف الجزامات

الجزامات وحدات التلفزيون

وحدات التلفزيون وحدات الحمام

وحدات الحمام غرف الاطفال

غرف الاطفال السراير

السراير ترابيزة قهوة

ترابيزة قهوة ترابيزة جانبية

ترابيزة جانبية

الركنات

الركنات كراسي

كراسي كنب سرير

كنب سرير ليزي بوي

ليزي بوي

المطابخ الجاهزة

المطابخ الجاهزة وحدات المطبخ

وحدات المطبخ دولاب

دولاب كومود

كومود