Even if you aren’t planning on growing any time soon, you need to have a sense of how much money is coming in vs. what is going out. On top of that, you need the data used in bookkeeping to file your taxes accurately. If you want your business to save time and money, then you should consider hiring a bookkeeping service. A bookkeeping service can help you stay organized and on top of your finances.

A CPA Firm Specialized in Startup Accounting & Finance

At Acuity, we’ve worked with tech startups for more than a decade using SaaS technology. With our strategic industry-specific planning, we’ll guide you through capital raises, financial modeling, investor relations, and so much more. Our toolbox of SaaS technologies automates many tedious, manual processes — bill pay, payroll, accounting solutions, and more — ultimately improving efficiency and accuracy across the board. Avoid costly errors and gain valuable financial insights with 1-800Accountant’s professional support. Startup accounting is an incredibly valuable, but tedious, aspect of running a startup. While the value gained by effective startup accounting is indisputable, knowing where to start can be a roadblock.

Can accounting software help with tax compliance?

Managing your own practice https://www.bookstime.com/ allows you the flexibility and control to choose niches that align with your personal career goals and work-life balance. Effective dental bookkeeping requires financial knowledge and an understanding of the unique aspects of dental operations. If bookkeeping is taking time away from patient care or growth initiatives, it’s time to delegate. These are common pain points for dental practice owners, but they don’t have to be your reality. That’s right—payroll taxes aren’t solely the federal government’s domain. Note that you aren’t the only one affected by late payroll tax payments.

Kruze

Students can also take advantage of the school’s five-year combined bachelor’s and MBA program. The bachelor’s in accounting includes all the prerequisites for the MBA degree, which helps shorten the completion timeline for the master’s program to one year. Networking is another crucial component of your marketing strategy. https://x.com/BooksTimeInc Establish relationships with local business owners, financial advisors, and legal professionals who may refer clients to you. Consider joining industry associations or attending local business events to get your name out there. Offering free resources like blog posts, webinars, or consultations can demonstrate your knowledge and provide value to potential clients.

Best Practices

At early-stage companies, decisions are made on tight timeframes. We know that your company is burning cash, and understand how important it is to get the financial data you need to make critical decisions. Kruze’s bookkeepers will work with you to find the financial delivery date that works for your needs. When a business takes outside money, they need to have a firm understanding of their books, since investors usually demand transparency.

Set up payroll system

VC due diligence is getting harder, so be prepared by working with an experienced pro. Kruze offers a variety of pricing plans to help startups afford accurate bookkeeping services. Bookkeepers have been preparing these financial packets for ages, but modern bookkeepers like Kruze use automated systems. Yes, many accounting software solutions offer features that assist with tax compliance. They can generate tax reports, track tax liabilities, and even integrate with tax filing services. This can help ensure your startup complies with tax regulations and deadlines.

- Bookkeeping involves tracking financial records such as income, deductions, credits, and expenses on a weekly or monthly basis.

- Startups need more than a robot to reconcile the accounts, they need a trusted advisor who is in tune with their unique growth path.

- We understand the unique challenges that come with growing a business and have the expertise you need to reach your goals.

- Stay vigilant with your cash flow to ensure your practice’s long-term success.

- Spreadsheets are great – every bookkeeper loves them – but you need to spend the $50 a month on a solid bookkeeping software like QuickBooks Online.

- The Bureau of Labor Statistics states that accounts are paid $78,000 annually or $37.50 per hour on average.

This may include forming a limited liability company (LLC) or a separate legal entity to protect your personal assets. These controls protect your practice from fraud, catch honest mistakes early and improve operational efficiency. They also enhance the accuracy of your financial data, providing peace of mind as you focus on patient care. Remember, robust internal controls are an investment in your practice’s long-term financial health and stability. Just as you meticulously chart every tooth, you need to account for every dollar in your practice. Comprehensive financial tracking is crucial for making informed decisions about your business.

Bookkeeping experience in the most important startup industries

Students get to experience the flexibility of online study and the interaction of on-campus learning. Online programs typically feature evening, weekend, accounting and bookkeeping service for startups or completely asynchronous classes. Online students enjoy reduced travel and more independent learning experiences. This makes online programs a good option for self-motivated learners who need to fit studies around work or other commitments.

Choose a Business Structure

It’s crucial to stay on top of this paperwork so that come tax time, you’re not scrambling to find receipts or reconstructing your finances from memory. Throughout the year, track all business expenses, income, and receipts. This way, you’ll be able to easily identify what’s deductible when tax time comes. By building a habit of regularly saving for taxes, you’ll avoid the shock of a large bill come tax time. It’s a simple way to protect your cash flow and reduce stress when filing season hits. Your business can be profitable, but if you run out of cash, it’s game over.

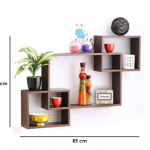

ارفف

ارفف الجزامات

الجزامات وحدات التلفزيون

وحدات التلفزيون وحدات الحمام

وحدات الحمام غرف الاطفال

غرف الاطفال السراير

السراير ترابيزة قهوة

ترابيزة قهوة ترابيزة جانبية

ترابيزة جانبية

الركنات

الركنات كراسي

كراسي كنب سرير

كنب سرير ليزي بوي

ليزي بوي

المطابخ الجاهزة

المطابخ الجاهزة وحدات المطبخ

وحدات المطبخ دولاب

دولاب كومود

كومود