Content

- Indicator No.1: A Trend-Following Tool

- Exploring The Types of Forex Trading Signals and Techniques

- A Beginner’s Guide to Forex: Understanding the Global Currency Market and Trading Strategies

- What are the benefits of FOREX signals services?

- – Entry price: This is the price at which you will enter the market.

- Adopting Forex Trading Strategy

- Predicting forex using interest rate parity and real interest rates

The FX Leaders FOREX signals system delivers real-time alerts on the major currency pairs along with in-depth analysis and trade ideas and recommendations. Interpreting forex signals requires a combination of technical analysis, fundamental analysis, and a deep https://www.xcritical.com/ understanding of market dynamics. Reading and interpreting forex exchange rates is a vital skill for forex traders. Understanding currency pairs, interpreting forex quotes, bid and ask prices, pipettes and pips, and the factors affecting exchange rates are all essential components of reading and interpreting forex exchange rates. By mastering these skills, traders can make informed trading decisions and increase their chances of success.

Indicator No.1: A Trend-Following Tool

But, always after testing what are forex signals their performance, to see if it meets the results they claim. FX Leaders is one of the mostpopular analysis and forex signals provider, empowered by a team of experienced analysts who utilize a variety of skills and strategies and are worth following for trade recommendations. Basically, you open a trade as soon as you get the alert for the trade, as a trading signal with the specified trading instrument, buy/sell action, entry price, take profit and stop losslevels. Traders with more experience often also add their experience, in order to increase profits, by nursing the trades andplaying with stop loss and take profit targets.

Exploring The Types of Forex Trading Signals and Techniques

Please pay attention to the trade ideas and market analysis sections, as we will continue to share our thoughts on market consensus. Also, HowToTrade has a lot of day-to-day trading instruments for traders with any level of experience. Get reliable trading signals as trade ideas tailored for forex traders, helping you navigate the forex market with expert insights.

A Beginner’s Guide to Forex: Understanding the Global Currency Market and Trading Strategies

- Too many inputs introduce a complexity requiring more time and as markets change over time, often with great speed, complex strategies could be rendered obsolete before testing is complete.

- Technical analysis involves reviewing past price activity, a complicated type of analysis that hones in on prior prices and support and resistance levels.

- Automated trades can also be back-tested to give users a greater sense of comfort.

- This information has been prepared by IG, a trading name of IG Markets Limited.

- For example, one commonly used technical indicator is the moving Average Convergence divergence (MACD).

They use various technical indicators, chart patterns, and other tools to identify potential opportunities for traders. Forex trading signals are one of the most powerful tools that a trader can have in their arsenal. They are a set of indicators that help traders make informed decisions about when to enter or exit trades.

What are the benefits of FOREX signals services?

Conversely, the trader might consider entering a short position if the 50-day is below the 200-day and the three-day RSI rises above a certain level, such as 80, which would indicate an overbought position. It is possible to make money using a countertrend approach to trading. However, for most traders, it’s easier to recognize the direction of a major trend and attempt to profit by trading in the trend’s direction. Let’s see why manual Forex trading signals give you higher profits than other types of Forex signals.

– Entry price: This is the price at which you will enter the market.

To solve this task, there were created special mathematical indicators, oscillators. Although there quite many types of oscillators, it is rather difficult for a trader to interpret what signal is delivered by the oscillator and how reliable this signal is. Choosing the right Forex signals provider involves thorough research and due diligence. Prioritize providers with a proven track record, transparency, and a strong reputation. Align their services with your trading style and risk tolerance to maximize your chances of success.

Adopting Forex Trading Strategy

This category of signals is based on how much detail is in the signal. Some signals only provide entry information, which is a cue for the trader to enter the market. Now that we know how signals are created, it is easy to see how customizable they are. Exit signals work best with long-term FOREX trading signals for investors who engage in position trading.

Reasons for Hiring a Professional Forex Signal Services

When reading exchange rates, the base currency is always equal to one unit. Autochartist creates our technical forex signals and Acuity creates our fundamental forex signals. Both providers are experts in their field – with more than 60 years’ combined experience.

The most widely used tool for this is the Commitment of Traders report published by the Commodity Futures Trading Commission, which details the long and short positions taken by investors on currency futures. The prevailing way to peg a value to currency at that time was via the gold standard, a monetary system in which a country’s currency had its value directly linked to the amount of gold it had in its reserves. However, many major economies decided to abandon that method in the early 1930s, leading to the birth of fiat currencies as we know them today.

Read on to discover the different types of forex signal, along with how to use them when trading currency pairs. After analysis, a trade signal triggers an action to either buy or sell a security or other asset. The trader can complete that analysis using technical indicators, or it can be generated using mathematical algorithms based on market activity and other economic indicators.

For instance, if the moving average crossover indicates a buy signal, you may also check if the RSI is not overbought and if the price is above a key support level. By waiting for confirmation signals, traders can reduce the risk of false signals and increase their chances of successful trades. You also need to implement risk management strategies to protect your capital.

With a longer duration, the scope of earning profits also increases – when it comes to long term forex signals, traders can generate up to hundreds or even thousands of pips with a single trade idea. In comparison, the shorter term signals offer trade ideas that last anywhere between a few minutes to a couple of days, and offer pips in the range of 15 to 50. The long term forex signals are exclusively available to our premium members, giving them the opportunity to rake in higher profits with careful and more detailed analysis. However, keep in mind that while long term signals offer an opportunity for higher profits, they come with the possibility for higher risk and may not be suitable for traders who prefer smaller levels of exposure.

This is the same as a line chart, except the area beneath the line is shaded, giving it the appearance of a mountain in silhouette. Like line charts, this type is mainly used to assess long-term trends, as the high, low and open prices for each period are not on show. And like any financial instrument in the wrong hands, signals can be a source of trouble. Only informed, educated, and motivated traders can use signals for their benefit.

An automated trading system involves the trader “teaching” the software what signals to look for and how to interpret them. It is thought that automated trading removes the psychological element that is detrimental to a lot of traders. Forex signal systems can create trades that are either manual or automated. A manual system involves a trader with a computer, looking for signals, and interpreting whether to buy or sell. A signal system for trading forex usually contains several different signals that work together to create a buy or sell decision. Trading signal systems may be available for free, for a fee, or are developed internally by traders.

A simple moving average represents the average closing price over a certain number of days. To elaborate, let’s look at two simple examples—one longer term, one shorter term. Example signal – You will receive signals with chart analysis as All signals given with chart analysis and the clear explanation for buy/sell which helps you to trade with confidence. We will send forex signals straight to your device by WhatsApp, Telegram or Email. Stop Loss – The Stop Loss in the signal represents the exit point, which is designed to provide cover in case things go wrong.

As you gain confidence, you’ll be able to determine pairs of indicators that will help pinpoint trade opportunities. Many forex traders spend their time looking for a perfect moment to enter a trade or a telltale sign that screams “buy” or “sell.” While the search can be fascinating, the results are hardly ever conclusive. As a result, traders must learn that there are a variety of indicators that can help to determine the best time to buy or sell a forex cross rate. Everybody wants to know in advance where the price will go and what trade should they enter.

Forex trading signals are the key to enhancing the accuracy of trading. It’s a system that helps traders make profitable decisions by providing them with real-time alerts on the market’s condition. These alerts contain important information such as buy/sell signals, entry/exit points, and stop-loss levels. With the help of these signals, traders can make informed decisions on when to enter or exit a trade, which can be the difference between a successful or failed trade. Forex signals are generated by a team of experts who closely monitor the market and analyze it from different perspectives.

This measures the price of a McDonald’s Big Mac in different countries around the world as an indicator of how currencies were performing. The idea is to work out what exchange rate would be needed to make a Big Mac that costs $5.00 in the US and €4.50 in Europe to be worth the same. If the current exchange rate is above or below that then, according to the PPP approach, it is possibly over or undervalued. We have a look at the various tools that investors can use when trading forex, as well as some different approaches that can be taken. Master risk management andbecome an expert forex trader.Move on to the advanced course. Communities are some of the best ways to learn about the entity you want to entrust your trading career to.

Numerous factors influence forex exchange rates, making them highly volatile. Economic indicators such as interest rates, inflation rates, GDP growth, and employment data significantly impact a country’s currency value. Additionally, political stability, government policies, trade balances, and market speculation also play a role in determining exchange rates. Foreign exchange rates play a crucial role in the global economy, facilitating international trade and investment.

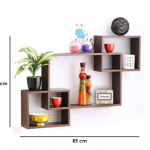

ارفف

ارفف الجزامات

الجزامات وحدات التلفزيون

وحدات التلفزيون وحدات الحمام

وحدات الحمام غرف الاطفال

غرف الاطفال السراير

السراير ترابيزة قهوة

ترابيزة قهوة ترابيزة جانبية

ترابيزة جانبية

الركنات

الركنات كراسي

كراسي كنب سرير

كنب سرير ليزي بوي

ليزي بوي

المطابخ الجاهزة

المطابخ الجاهزة وحدات المطبخ

وحدات المطبخ دولاب

دولاب كومود

كومود