David Axler is the Chief Strategy Officer, focusing on formulating, communicating, and fulfilling Wave’s initiatives and future goals. With over five years at Wave, David brings an enthusiastic leadership style and unyielding service to our customers. Prior to Wave, David was a GM and Chief of Staff at a B2B technology company, what is contributed surplus on a balance sheet Influitive, and was previously a management consultant with Deloitte.

Accounting software that works as hard as you do

He comes to Wave with decades of executive experience, most recently as General Manager for Afterpay North America, and previously as Executive Vice what is the 1099 form for small businesses President at Mastercard. He joined Mastercard in 2012 as Chief Executive Officer for Mobile Payment Solutions (MPS) where he was responsible for deploying mobile solutions in Brazil, Argentina, Egypt, Indonesia, Philippines, India and Turkey. Know when an invoice is viewed, becomes due, or gets paid, so you can stay on top of your cash flow better than ever. Monitor your cash flow, stay organized, and stop sweating tax season. Say #sorrynotsorry to your spreadsheets and shoeboxes.

She is a proud mom and aspiring chef who enjoys all things cottage life, giving back to her community, and spending time with family and friends. I am a freelancer and have been using Waveaps for about 4 years.Quickbooks and Xero no doubt have more features but Waveapps has all the functionality I need. I just cant get my head round that its completely free! If you are a freelancer and want a simple to use system for invoicing your clients and tracking expenses, Waveapps is perfect. Several bugs they refuse to fix and very poor communication. I’ve reported one of the bugs a dozen times over the past year and they won’t fix (type in the date in the bills page and it crashes the whole site).

The Trustpilot Experience

I’m giving one star because ZERO stars is not an option. Forget about customer service – and I’m a paying customer! DO NOT consider switching to Wave if you have any credit cards from American Express. For the last year, Wave has failed to maintain a connection with AMEX, which means that I have to download statements from AMEX to upload to Wave and then spend hours classifying every single transaction. And here’s the best part – I pay Wave to do their job! Wave does not charge a subscription or any hidden fees.

While users never pay a monthly fee, they will have to pay a credit card processing fee of 2.9% plus 30 cents per transaction if they use Wave to process credit card payments. This fee can vary depending on the type of card the customer uses. Whether you are struggling with sending out invoices on time, keeping track of payments or organizing tax information, Wave helps business owners get a handle on their accounting department at no monthly cost. While several accounting software services provide a free version of their software, the free version usually limits the number of users, number of invoices per month and integrations. With Wave’s Pro Plan, you can set up recurring invoices and automatic credit card payments for your repeat customers.

Wave Financial Inc

Wave users can accept credit card payments over the phone, online or in person. Add a “Pay Now” button on invoices and you will automatically be able to receive Apple Pay, credit card payments and bank transfers. Money is typically deposited into accounts within two business days and all payments are recorded to have you set when tax season rolls around. Note that you will pay credit card processing fees the most common tax deductions on all applicable transactions. While its limitations do not make it an ideal solution for every business, Wave is a particularly appealing option for freelancers who are just starting out.

- The drawback of just offering one plan is that it limits room for growth.

- We also ensure all reviews are published without moderation.

- Our robust small business accounting reports are easy to use and show month-to-month or year-to-year comparisons so you can easily identify cash flow trends.

- While Wave provides unlimited invoices, it might be best to look elsewhere if you are looking for more robust account software.

We use dedicated people and clever technology to safeguard our platform. People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active. Suggested companies are based on people’s browsing tendencies. Between the app and the payment process—I can’t tell you the hours it’s saved, and even the headaches that have gone away because of it. Easily monitor and keep track of what’s going on in your business with the intuitive dashboard. The quick summary allows you to stay in control of your business finances, including a task list of outstanding items.

At this point it’s a disaster and what was supposed to save time..has created a time deficit.I am in a state of shock at the moment and wondering what the most courteous, professional course of action is for moving forward. The free service is fine, but beyond that, look elsewhere. Also, no way to reach a real human now for customer service. This app is super helpful, the main issue I have while using it is the lag. When inputting information the character count for it is super slow/delayed to where it forces me to stay on a certain page until it registers that information has been inputted.

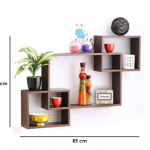

ارفف

ارفف الجزامات

الجزامات وحدات التلفزيون

وحدات التلفزيون وحدات الحمام

وحدات الحمام غرف الاطفال

غرف الاطفال السراير

السراير ترابيزة قهوة

ترابيزة قهوة ترابيزة جانبية

ترابيزة جانبية

الركنات

الركنات كراسي

كراسي كنب سرير

كنب سرير ليزي بوي

ليزي بوي

المطابخ الجاهزة

المطابخ الجاهزة وحدات المطبخ

وحدات المطبخ دولاب

دولاب كومود

كومود