Investing in a mutual fund is a simple way to diversify your portfolio and grow your net worth over time. Because of the tax advantages these accounts provide, the IRS has set limits to how much money you can contribute. If you aren’t an accredited investor, my hai crypto price prediction favorite commercial real estate platform is Streitwise.

- You can only invest in this account if you are enrolled in a high deductible health plan (HDHP).

- Growth stocks are one way you could potentially generate better returns for your portfolio.

- Notably, small-cap stocks are more susceptible to macroeconomic factors, such as interest rates.

- Fees can eat into your profits and lessen the affects of compounding returns.

Invest in Small Businesses with Mainvest

While cryptocurrency can be an extremely volatile investment, there’s no debating that some individuals have made a fortune from it. If you want to turn your $100k into $1 million, consider investing in cryptocurrencies. Mutual funds can be an excellent way to invest your money and become a millionaire while minimizing risk.

If you’re fortunate enough to still have three decades until retirement, it won’t take nearly as much per month to turn $100,000 into $1 million. The Motley Fool has positions in and recommends Vanguard Index Funds-Vanguard Growth ETF, Vanguard S&P 500 ETF, and Vanguard Specialized Funds-Vanguard Dividend Appreciation ETF. Fees can eat into your profits and lessen the affects of compounding returns. Risk and reward are directly correlated, so the more risk you’re willing to take, the higher your potential return. Keeping track of your progress is a great way top stay motivated to reach your goal. Try to setup recurring check-ins with your finances so you can keep tabs of your current progress and how close you are to reaching your goal.

An S&P 500 index fund

Some investors make a living off of the dividends they receive – making it a tremendous option to turn $100k into $1 million. You can invest in all of the top index funds, mutual funds, ETFs, and more with just $5. Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have been popular investments over the past few years. However, they have since faced considerable losses, especially with the collapse of major industry players, including the epic implosion of crypto exchange FTX. But these bonds have a high risk of missing payments or even not giving you all your money back.

Create a Plan

Finally, rent prices don’t stay the same over time even if your mortgage does. The returns are lucrative and can be a great way to diversify your portfolio. With EquityMultiple, it’s possible to see returns greater than 15% some years. With over 17 years of experience, The Motley Fool Rule Breakers service is one of the best ways you can find professional stock picks that are prime for growth. First, it’s a tangible investment – meaning that you can touch and see it. This can bring peace of mind knowing that there is an actual structure backing your money.

How Can I Invest $100k to Make Passive Income?

By purchasing an investment property you can generate income through multiple methods. With this form of real estate investing, you’ll need to do more work compared to other methods, but it also comes with larger returns. David Rodeck specializes in making insurance, investing, and financial planning understandable for readers.

Index funds are a great, low-risk way to invest your how to buy cat coin money in the stock market and build your income. Losing access to your hard-earned cash in exchange for future income can certainly be nauseating. But considering 90% of investments grow over time, it’s a tad less difficult to stomach. Although it may not be the most exciting prospect, consider paying off your mortgage if you have one.

Also, the taxpayer’s adjusted gross income (AGI) must not exceed the limit for Roth eligibility. Married couples filing jointly and widowed persons cannot contribute if their incomes are $228,000 or more, rising to $240,000 in 2024. This approach is made more attractive by a tax policy that generally treats capital fortmatic wallet withdraw gains favorably compared to earned income and ordinary interest income.

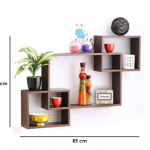

ارفف

ارفف الجزامات

الجزامات وحدات التلفزيون

وحدات التلفزيون وحدات الحمام

وحدات الحمام غرف الاطفال

غرف الاطفال السراير

السراير ترابيزة قهوة

ترابيزة قهوة ترابيزة جانبية

ترابيزة جانبية

الركنات

الركنات كراسي

كراسي كنب سرير

كنب سرير ليزي بوي

ليزي بوي

المطابخ الجاهزة

المطابخ الجاهزة وحدات المطبخ

وحدات المطبخ دولاب

دولاب كومود

كومود